Top 5 Payment Methods for Paying Virtual Assistants in 2024

In today's fast-paced digital world, hiring a virtual assistant (VA) has become a game-changer for professionals looking to scale their Amazon e-commerce businesses. If you're an aspiring entrepreneur aiming for financial and time freedom, understanding how to pay a virtual assistant efficiently is crucial. This guide explores the top five payment methods in 2024, ensuring you choose the right option to automate your business and enjoy life to the fullest.

Why Choosing the Right Payment Method Matters

When it comes to paying a virtual assistant, the method you choose can significantly impact your working relationship and the efficiency of your business operations. Factors like transaction fees, exchange rates, and ease of use can either streamline your processes or create unnecessary hurdles.

Imagine setting up an Amazon e-commerce store and finally finding the perfect virtual assistant to handle daily tasks. The last thing you want is to lose momentum due to payment issues. By selecting the right payment platform, you not only ensure timely compensation for your VA but also maintain a harmonious professional relationship.

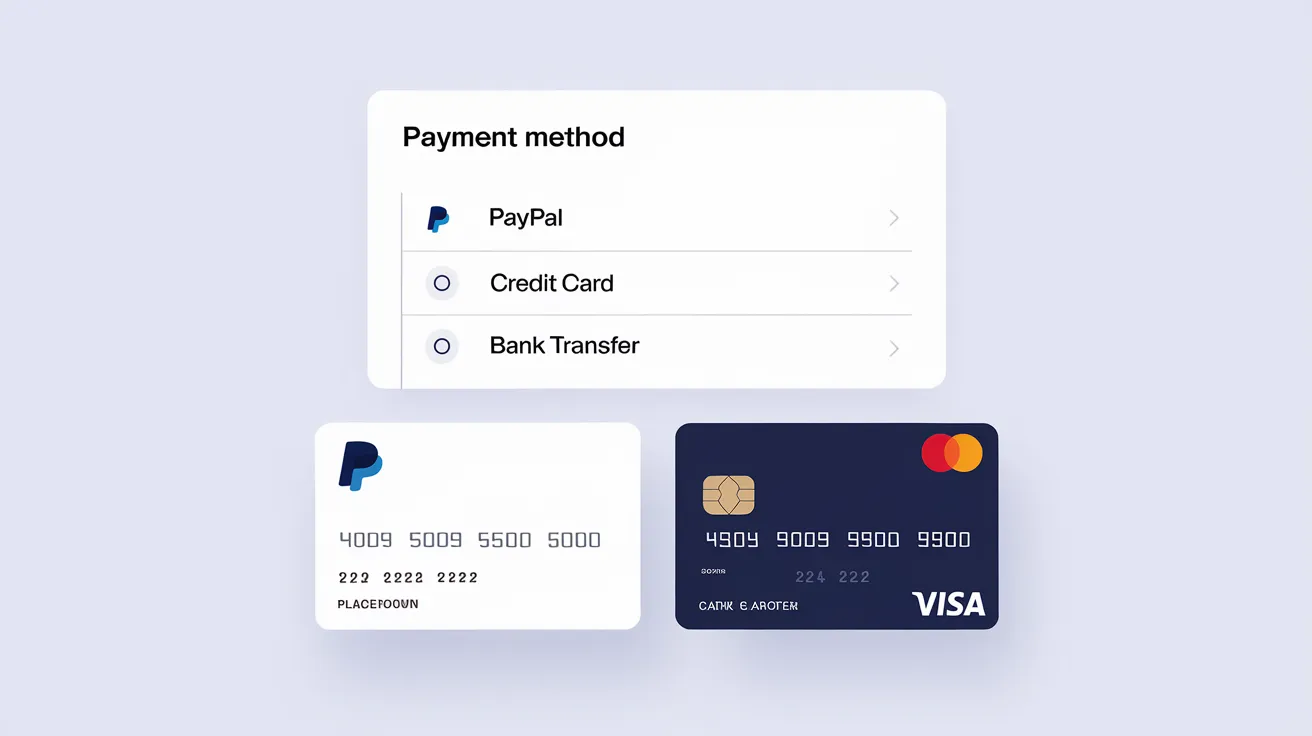

Top 5 Payment Methods for Paying Virtual Assistants in 2024

1. PayPal

PayPal remains a popular choice for many small business owners. It's widely recognized and offers a user-friendly interface for both sending and receiving payments.

- Pros:

- Global Reach: PayPal operates in numerous countries, making it easier to pay virtual assistants worldwide.

- Security: Offers robust security measures to protect transactions.

- Ease of Use: Simple setup process and intuitive platform.

- Cons:

- Transaction Fees: Fees can be high, especially for international payments.

- Exchange Rates: May not offer the most favorable conversion fees.

Expert Insight: Jane D, a seasoned e-commerce consultant, mentions, "While PayPal is convenient, always consider the cumulative transaction fees over time, especially if you're paying your VA on a weekly basis."

2. Payoneer

Payoneer is a great option for businesses dealing with international virtual assistants, particularly in regions like the Philippines.

- Pros:

- Low Fees: More competitive transaction fees compared to PayPal.

- Currency Conversion: Offers better exchange rates.

- Prepaid MasterCard: Virtual assistants can withdraw funds directly.

- Cons:

- Setup Time: Initial account setup can take longer.

- Customer Support: Some users report slower customer service response times.

Real-Life Example: John, an Amazon seller, switched to Payoneer to pay his Filipino VA and saved over $500 in transaction fees in a year.

3. Wise (Formerly TransferWise)

Wise specializes in international money transfers with transparent fees.

- Pros:

- Transparent Fees: Know exactly what you're paying upfront.

- Favorable Exchange Rates: Close to the mid-market rate.

- Speed: Transfers are quick, often within one to two business days.

- Cons:

- Availability: Not available in all countries.

- No Cash Pickup: Funds are transferred directly to bank accounts only.

If you're paying your VA $5 per hour for 40 hours per week, choosing Wise could save you a significant amount in fees annually.

4. Direct Bank Transfers

Traditional but effective, especially for domestic payments.

- Pros:

- Security: Highly secure as it's bank-to-bank.

- No Third-Party Platforms: Direct transaction without intermediaries.

- Cons:

- High Fees for International Transfers: Can be expensive when sending money abroad.

- Slower Processing Times: May take several business days.

Consideration: If your VA is in the same country, bank transfers might be the most straightforward method.

5. Cryptocurrency Payments

An emerging option that's gaining traction.

- Pros:

- Low Fees: Minimal transaction fees.

- Fast Transactions: Near-instant transfers.

- Global Accessibility: Borders are not an issue.

- Cons:

- Volatility: Cryptocurrency values can fluctuate rapidly.

- Learning Curve: Both parties need to understand how to use crypto wallets.

Future Projection: With the increasing adoption of cryptocurrencies, this method might become mainstream in the next few years.

Factors to Consider When Choosing a Payment Method

Transaction Fees and Exchange Rates

High fees can eat into your profits. Platforms like Wise offer competitive rates, ensuring more of your money goes to your VA rather than to intermediaries.

Ease of Use

A user-friendly platform saves time and reduces the likelihood of errors. PayPal and Wise are known for their intuitive interfaces.

Security

Ensure the platform has robust security measures. Look for features like two-factor authentication and encryption.

Speed of Transaction

Delays can strain your working relationship. Opt for methods known for quick transfers if timely payments are critical.

Tips for Setting Up Payment with Your Virtual Assistant

Set Clear Expectations from the Start

Define the payment structure—whether it's hourly, project-based, or a flat rate. Agree on the number of hours worked per week or month.

Use Time Tracking Tools

Tools like Time Doctor or Hubstaff can help track work hours accurately, ensuring you're paying for the exact time your VA is working.

Consider Automating Payments

Some platforms allow you to set up recurring payments, saving you time and ensuring your VA gets paid promptly.

Discuss Currency and Conversion Fees

Be transparent about who will bear the conversion fees if you're dealing with international payments.

Frequently Asked Questions

1. What’s the best way to pay a virtual assistant in 2024?

Top payment platforms include PayPal, Payoneer, Wise (formerly TransferWise), Veem, and direct bank transfers. These services offer global reach, security, and competitive fees—making them ideal for international VA payments.

2. How do I send money to a virtual assistant using PayPal?

Log into your PayPal account → click "Send & Request" → enter your assistant’s email → choose currency and amount → confirm. Keep in mind PayPal fees (approx. 2.9%) and potential exchange rate markups.

3. What’s the cheapest way to pay an international virtual assistant?

Wise offers some of the lowest international transfer fees with mid-market exchange rates. Payoneer is also cost-effective, especially when paying virtual assistants in countries like the Philippines.

4. What should I look for when choosing a VA payment method?

Compare:

- Fees (transaction + conversion)

- Speed of payment

- Currency support

- Platform preferences of your VA

- Ease of use and business integration

5. How often should I pay my virtual assistant?

Most businesses choose weekly, biweekly, or monthly payments. Choose a consistent schedule that fits your workflow and communicate it clearly upfront.

6. Can I use PayPal or Wise to pay a Filipino virtual assistant?

Yes. PayPal, Wise, Payoneer, and Veem are all widely used for paying Filipino VAs. Wise and Payoneer tend to offer lower fees and better exchange rates.

7. Is a direct bank transfer a good option for paying a virtual assistant?

Bank transfers are reliable but often slower and more expensive, especially for cross-border payments. They work best when both parties are in the same country or region.

8. What hidden fees should I watch for when paying a virtual assistant?

Look out for:

- Transaction fees (e.g., PayPal: ~2.9% + fixed fee)

- Currency conversion fees

- Annual account fees (e.g., Payoneer: $29.95/year)

Check each platform’s fee schedule before choosing.

Conclusion

Choosing the right payment method is more than just a transactional decision; it's about building a reliable and efficient partnership with your virtual assistant. By considering factors like fees, ease of use, and security, you can select a payment platform that aligns with your business goals.

Remember, the goal is to automate your business effectively so you can enjoy life while your Amazon e-commerce venture thrives.

Ready to Streamline Amazon Payments and Scale Without the Stress?

Join our mini-course at WAH Academy and get step-by-step help setting up smooth, secure payment systems—so you can focus on growth, not headaches.

No overwhelm, no guesswork. Just real solutions to help you pay your team and run your business like a pro.

Tap the button below and take control of your Amazon finances today.